Thailand Political Risk: Will the Hat Yai Floods Trigger a December Dissolution?

Executive Summary

The Hat Yai Crisis and the December Dissolution Risk

Thailand is entering a period of heightened sensitivity as the Hat Yai floods evolve from a humanitarian disaster into a constitutional pivot point. This operational crisis has stripped the "Blue" coalition of its competency narrative at a critical moment, accelerating a timeline that points toward a House Dissolution by 12 December 2025.

Our analysis identifies three cascading risks for the transition into Q1 2026:

The Constitutional Trap: The Opposition is preparing an Article 151 No-Confidence Motion, creating a "Death Race" where the Prime Minister must dissolve Parliament immediately or face a legislative lock-down.

The Governance Vacuum: A January election would leave Thailand under a caretaker administration restricted by Article 169, effectively freezing major infrastructure approvals and budget allocations until May.

The Fiscal Cliff: With public debt projecting toward 68% of GDP and growth slowing to 2.0%, the state lacks the legal and fiscal agility to finance a rapid post-flood recovery during the caretaker period.

This briefing outlines the regulatory timelines and scenario matrix for investors navigating Thailand’s volatile transition into 2026.

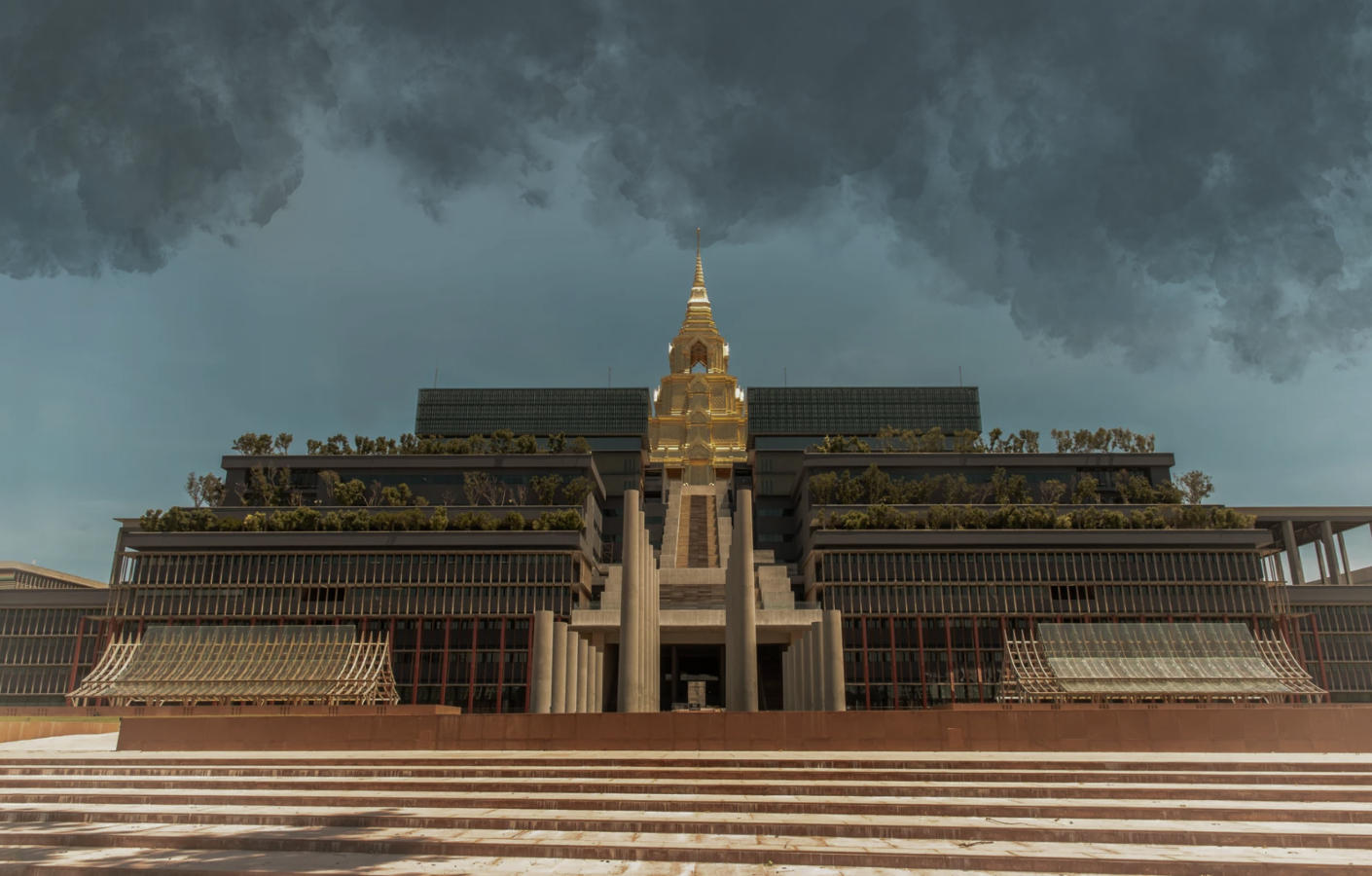

Photo Credit: Reuters

Thailand is entering a period of heightened political and administrative sensitivity. The Hat Yai floods have created far-reaching consequences beyond the immediate humanitarian and economic impact. They have added stress to an already delicate political environment and accelerated a complex constitutional sequence with potential implications for governance in early 2026.

With GDP growth slowing to approximately 2.0 percent, Thailand is navigating a challenging economic backdrop. The possibility of a parliamentary dissolution on December 12 has raised concerns about policy continuity and public sector decision-making during the first quarter of next year.

Under Article 151 of the Constitution, the filing of a no-confidence motion immediately restricts the Prime Minister’s ability to dissolve Parliament. This has resulted in a compressed timeline in which political actors are managing both constitutional requirements and the public expectation for accountability following the floods.

Investors and diplomatic observers should be prepared for the possibility of limited policy flexibility and slower administrative decision-making during January and February 2026.

This analysis reflects regulatory timelines and constitutional mechanisms as of November 30, 2025. Sector examples are illustrative of broader risk categories.

1. Coalition Stability: The 'Blue' Government and Senate Silence

Prime Minister Anutin Charnvirakul assumed office in September 2025 through a narrow parliamentary alignment. His minority government was facilitated by support from the People’s Party, contingent upon advancing deliberations on the Article 256 Constitution Amendment.

This arrangement carried inherent fragility. The Hat Yai crisis has intensified scrutiny on the government’s operational capacity and political stability.

Institutional Quiet from the Senate

The 200-member Senate has maintained a notably low profile during the response to the Hat Yai floods. There have been no extraordinary committee interventions or public efforts to reinforce the government’s narrative.

While there are many possible reasons for this approach, observers note that it reflects a cautious institutional posture. In Thailand’s political landscape, such quietness can indicate an environment in which key actors are awaiting clarity before taking visible positions.

2. The Competency Question: Operational Pressure on a Logistics-Branded Party

Bhumjaithai has long positioned itself as a party focused on practical management, public service delivery and operational execution. The Hat Yai floods have challenged this perception by exposing weaknesses in early-warning systems, interagency coordination and crisis logistics.

This moment has triggered renewed debate about the gap between stated capability and practical crisis response.

The 9,000 Baht Relief Programme

The Cabinet approved a relief package offering 9,000 THB per household and 2 million THB compensation for each fatality. While this represents significant financial assistance, it is important to understand the broader economic context.

According to the Thai Chamber of Commerce, Hat Yai’s total economic losses may exceed 25 billion THB. The current relief package therefore covers less than 10 percent of estimated damage, placing the spotlight on medium and long-term recovery planning for Southern Thailand.

Historical Echo: A Repeated Stress Pattern

The Hat Yai crisis resonates with earlier moments in which national systems struggled under pressure.

COVID-19 Response Dynamics

During the early phases of the COVID-19 pandemic, Thailand faced challenges related to communication clarity, early assessment of evolving risks and balancing centralised control with local needs. Some of those same coordination challenges appear to have resurfaced during the flood emergency.

The March 28, 2025 Earthquake

The 7.7 magnitude earthquake that shook Bangkok revealed critical vulnerabilities in the national Cell Broadcast early-warning system. Despite public assurances of improvement, that system again underperformed during the Hat Yai flood event.

This repetition of early-warning gaps underscores the need for sustained investment and operational reform.

Reduced Buffer from the Civil Service

Historically, Thailand’s professional civil service has played a stabilising role during crises. Doctors, engineers and local officials often stepped in to compensate for imperfect coordination. In Hat Yai, the sudden collapse of physical infrastructure limited the extent to which bureaucratic capacity could cushion the pressure on political leadership.

Systemic Cabinet Paralysis

The operational disconnect appears to extend beyond the Prime Minister’s office. Analysts have noted a "silence of the portfolios," where key support ministries which is vital for disaster response remained largely invisible during the critical 72-hour window. This suggests a broader breakdown in the coalition’s command-and-control structure, where the "Quota System" of cabinet appointments (prioritising factional balance over technical expertise) has limited the administration's ability to mobilise a whole-of-government response.

The "Recovery Lag" Trap

Perhaps the most dangerous variable is the timing of the aftermath. Experience from 2011 suggests that public sentiment often deteriorates after the floodwaters recede, as households confront the reality of economic ruin, disease risks, and clean-up costs.

If the House is dissolved in December, the coalition will be forced to campaign in January, precisely during the "Peak Frustration" phase of the recovery. Instead of distributing stimulus checks in a stable environment, candidates may find themselves canvassing in communities that feel abandoned by the central state.

3. The December 12 Tripwire

Thailand now faces a precise constitutional sequence.

The Article 151 Trigger

Under Article 151, once a no-confidence motion is officially filed with the Speaker, the Prime Minister is constitutionally barred from dissolving Parliament until the process concludes. The mechanism is automatic.

A Narrow Window

The Opposition intends to submit the motion as late as possible. For the Prime Minister, the only window to dissolve Parliament before being bound by Article 151 is prior to formal receipt of the motion.

This creates a compressed timeline in which both sides are making decisions with limited margin for error.

Constitution Day Sensitivity

The second reading of the Article 256 Amendment is scheduled for December 10, which is Constitution Day. Any unexpected delay on this date would be especially sensitive, given the symbolism and public expectations attached.

Strategic Note: The "Cage" vs. The "Stage"

Investors have asked whether the Opposition might utilise a General Debate (Article 152) instead of a No-Confidence Motion (Article 151). The choice represents a distinct strategic trade-off:

Option A: The Cage (Article 151): Filing this motion legally "locks" the Prime Minister from dissolving Parliament. It forces a vote and is the only mechanism to stop an early election.

Option B: The Stage (Article 152): This motion allows for a general inquiry without a vote. Crucially, it does not ban dissolution.

The Pivot: While Article 151 remains the primary threat to government survival, intelligence suggests the Opposition may consider Article 152 as a "Scorched Earth" contingency.

In this scenario, they would utilise the parliamentary platform to launch a comprehensive, televised critique of the government’s performance effectively turning the debate into a pre-election "grand inquest."

The goal would not be to stop the dissolution, but to destroy the administration’s narrative credibility immediately prior to the campaign period.

If the Opposition pivots to Article 152, markets should interpret this as a signal that the election campaign has unofficially begun.

December 12: The Final Trigger

Parliament reconvenes on December 12 at 1.30 PM. If the government were to dissolve Parliament, it would likely need to occur before the session begins. A dissolution at that time would typically result in a national election in late January or early February 2026.

4. Market Scenarios: The Investor Matrix

Scenario A - Dissolution on 12 December

Election timeframe: late January to early February 2026

Government authority: caretaker administration

Market mood: cautious to risk averse

Likely outcomes:

Slowing of power and energy negotiations

Pause in transport and logistics concessions

Delays in infrastructure-linked investment decisions

Freezing of major approvals by state agencies

Fiscal capacity constraints due to caretaker rules

Thailand’s public debt-to-GDP is expected to reach 68 percent by year-end, while GDP growth forecasts have been revised to 1.8 percent. A caretaker government cannot take on significant new borrowing, which may limit the pace of economic recovery in affected provinces.

This scenario creates both a political and fiscal vacuum.

Scenario B - Government Continues Until March 2026

Election timeframe: April to May

Government authority: functioning but politically constrained

Market mood: uneasy but stable

Major projects would experience slower progress, but administrative continuity would largely be preserved. For many investors, this would be the more predictable path.

Critical Watch List: December 1 to 12

A practical checklist for investors and diplomatic observers.

December 5, Father’s Day: Monitor for ceremonial developments during national observances.

December 9: Finalisation of parliamentary agenda.

December 10, Constitution Day: Observe for delays or procedural disputes - second reading of the Article 256 Amendment

December 11: Final pre-dissolution window.

December 12: Parliament reconvenes at 1.30 PM. Monitor the Royal Gazette throughout the morning.

The Hat Yai crisis is more than an isolated emergency. It has exposed systemic vulnerabilities in Thailand’s crisis-management architecture and accelerated a constitutional sequence with wide-ranging implications for governance, market sentiment and national planning.

The coming days will determine whether Thailand moves toward early elections or maintains continuity into early 2026.